How Maintenance Programs Are Draining Profits

This is part 1 of 2 of our Open Letter on Residential HVAC Maintenance Programs.

My career has been spent on solving technical problems at scale – but as with all problems in life, a tool is only part of the solution. measureQuick can be an invaluable tool for a tech on a maintenance visit, but what if the way we promote, sell, and dispatch these visits produces negative value for our businesses?

To put it bluntly: our maintenance programs are a financial black hole, our churn rates are off the charts, and our sales process leaks like a sieve. Yet we go on with running our HVAC businesses as if there is no other choice.

This isn’t just about the bottom line. It’s about the colossal waste of resources, missed opportunities, and customer disappointment – all of which we choose to ignore. We’re not just losing profits, we’re failing ourselves, our customers, our employees, and our industry. We need to ditch outdated practices and champion innovation. If we don’t, we’re failing everyone.

So come with us to explore the broken nature of our industry’s “cash cow” built of pyrite: maintenance agreements.

– Jim Bergmann

tl;dr:

- We assume HVAC maintenance programs are profitable because of a few compelling claims which the industry follows – but we don’t question the validity of those claims

- The reality is that most maintenance programs lose money and nearly half of customers cancel after the first year, which damages company valuations

- Shifting consumer behavior and economic conditions has changed the stakes of maintenance programs, so your business needs to change along with the times

How Did We Get Here?

What Maintenance Programs Were Supposed to Do

The premise is simple: incentivize better outcomes through business transaction, which should benefit all parties involved.

HVAC Maintenance programs are designed to ensure system longevity and efficiency, and to increase contractor revenue. Regular tuneups can prevent major issues, with extensive research from the U.S. Department of Energy confirming that regular maintenance improves system performance and lifespan.

Manufacturers have played a key role in driving the growth of maintenance programs through warranty requirements. Homeowners have been trained neglecting regular service, improper installation, and failure to register the warranty within a specified period will invalidate a warranty. Nearly all manufacturers now offer 5+ year warranties on equipment (sometimes labor as well), and maintenance programs are the key for maintaining these warranties for homeowners.

These programs also help contractors smooth out seasonal demand fluctuations. A portfolio of 500 service contracts was seen as a sustainability threshold, with revenue coming from maintenance visits and the repairs and replacements that often result. However, shifting from an equipment to a service focus can be challenging for smaller contractors.

In the HVAC industry, 60 to 70% of sales come from existing customers, and increasing customer retention rates by just 5% can boost profitability by 25% to 95%. Furthermore, some studies have shown that a successful maintenance contract program can account for 50% or more of an HVAC company’s annual revenue, making the business more attractive for investment or acquisition.

But most businesses never reap the benefits they assume are generated by their maintenance programs.

Assumptions We Build Our Businesses On

The business case for maintenance programs is based on a number of assumptions, which are not reflected in the reality of today’s market.

The first assumption is that maintenance agreements automatically produce customer loyalty. The idea is that by providing a regular service, contractors can build a relationship with homeowners and become their go-to choice for all their HVAC needs. However, the reality is quite different, and the problem lies in why homeowners agree to maintenance agreements in the first place.

The second assumption is that maintenance programs are easy to sell to homeowners – they’re a win-win proposition for both contractors and homeowners, right? How could customers say no? However, the reality is that selling maintenance programs is a challenge. It requires convincing homeowners to invest in a service that they might not immediately see the benefits of. This can be a tough sell, especially in a market where consumers are becoming increasingly cost-conscious.

The third assumption is that maintenance programs are profitable or will lead to a valuation multiple for the business. How many companies actually break down the costs of their maintenance programs? Are all those discounts you’re offering to capture a year one maintenance contract resulting in more sales, or longer customer relationships? And when’s the last time you’ve spoken with investors about how they would value your company?

The Problem with Maintenance Programs

The Loss Leader Dilemma

Maintenance programs in residential HVAC companies often serve as loss leaders, a strategy used to attract customers with low-cost services in hopes of upselling more profitable ones. However, when upselling fails, companies bear the cost, leading to potential financial losses. This impact can be substantial, threatening the profit margins of small and medium-sized businesses, and even affecting the bottom line of larger companies over time.

The Sales Difficulty

Selling maintenance programs, a preventative measure, to homeowners who often adopt a reactive approach is a challenge. It demands skilled salespeople who can articulate the long-term benefits of regular maintenance, a tough sell in a cost-conscious market. This is particularly challenging for small HVAC businesses without a dedicated sales team, as most technicians prefer focusing on quality work over sales.

Moreover, homeowners don’t trust HVAC contractors like they used to and don’t value their HVAC system, making every sale even more difficult. Every other product and service already has filled up their attention and share of wallet – so why should they value you if you only visit once or twice a year? If you aren’t reminding them of the value, it will fade from their mind. That’s one of the main reasons why products like SmartAC.com exist, which we’ll talk about later in this letter.

The Churn Rate Challenge

We’ve recently conducted interviews with hundreds of homeowners and contractors, which have revealed that maintenance programs have a 30-50% churn rate annually. That’s a staggering statistic, which not only means lost revenue but also missed opportunities for long-term relationships and signals a lack of customer loyalty and delivered value. Considering it costs five times more to attract a new customer than retain an existing one, this churn can inflate marketing costs, impacting the bottom line.

Death By A Thousand Discounts

Well-meaning businesses try to sell these agreements while aligning the interests of all stakeholders involved. Business owners need revenue and retention, techs want to stay busy in the shoulder season, CSRs want commissions or spiffs, distributors want the equipment lifetime extended, and homeowners… often just want the day one discounts.

At the end of the day, that’s what the hundreds of homeowners we’ve interviewed have told us: they just want discounts on labor or parts during the first visit, NOT the following years of service. By incentivizing our CSRs or dispatchers to sell as many agreements as possible is a disservice to the customer and our industry – punching holes in our buckets for customers to leak out. Homeowners are guaranteed to churn when sold something they don’t really want. Sears followed this model for years, and it never worked out for them – so who’s bright idea was to apply such a broken model to HVAC?

The New Norms of Company Valuation

John Ellis of The New Flat Rate recently shared that there’s a shift in how companies are being evaluated by investors. Improperly run maintenance programs have become a liability, not an asset. So if your portfolio of 300+ maintenance customers is built on a high-churn, loss leader business model, you should think twice about pursuing investment.

Instead, investors are asking HVAC companies to break out their P&L into separate departments – installation, service, and maintenance – evaluated independently. This requires maintenance techs and CSRs to be generating enough revenue to offset the churn and acquisition costs of these customers, which can be challenging if you aren’t also seeing efficiency gains using purpose-built digital tools and platforms.

To overcome these challenges, HVAC companies need to rethink their approach to maintenance programs.

Are Maintenance Plans Dead?

“Is it still practical for our company offer a membership plan to our customer base?”

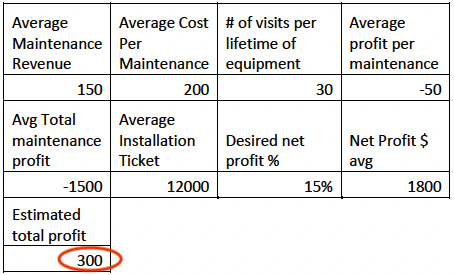

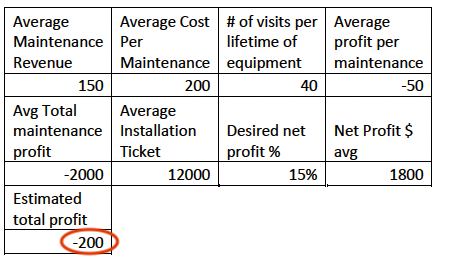

A forward thinking service manager of a medium sized HVAC business in the Midwest sent me a letter that he submitted to his company’s owners, outlining the financial reality of their maintenance department. With just a few spreadsheets, he was able to demonstrate that the profits gained from maintenance leads was erased by the net loss of maintenance and the adjustment revenue.

Below is the summary tables of his findings, which you should take note of if you’re running a maintenance department (your net losses are probably worse).

“For all of our efforts, a new installation after figuring in the maintenance losses made 2.5% net profit. Once we get to the 20-year mark, we can see that we are operating at a complete loss.”

You can download the full text of this Service Manager’s letter here, which includes a detailed breakdown of the problems with the typical maintenance model.

“Are memberships dead? If they aren’t dead yet, then they are knocking on death’s door.”

Survive & Thrive, Or Get Eaten Alive

With the specter of a recession, the market is becoming fiercely competitive, leading to resource wastage and missed opportunities. The 2008 recession hit the industry hard, especially the residential sector, with a significant decline in sales, some businesses experiencing a drop of over 38 percent in a two-year period.

The industry is now facing a severe shortage of HVACR service workers, with a deficit of 70,000-80,000 jobs across the country. This shortage, coupled with the high rate of business closures and mergers, paints a grim picture for the industry.

However, the landscape of the residential HVAC industry has been vastly changed by COVID-19. The pandemic has increased the importance of HVAC systems, leading to a surge in demand for HVAC services. This has attracted private equity (PE) firms, which see HVAC as an essential service in high demand regardless of the economic conditions.

PE firms are attracted to the HVAC industry because it is growing rapidly and there is plenty of money to be made. The HVAC industry is benefiting from several positive trends, including the increased importance placed on HVAC systems due to the pandemic, and the emergence of new technologies that are revolutionizing the industry.

However, the influx of PE into the HVAC industry also brings increased risks. PE firms often take on large amounts of debt to finance their acquisitions, putting the companies they buy at risk of default if business slows down. Navigating private equity could help or harm the market, depending on how it will be managed. So if you’re a HVAC business owner looking to sell, you’d better get your books in order soon since experts are seeing “substantial slowing down of deals, multiples coming down”. And PE companies have the advantage when purchasing inefficient companies – leveraging your leaky bucket to buy low, plug the holes, then flip the company for a profit. That’s a lot of value you’d be giving away.

Consumer behavior is also changing – influenced by the uncertain economy, an aging population, climate change, and decades of mediocre experiences with HVAC contractors. Homeowners don’t understand the complexity of their HVAC systems, (nor the process required to install and maintain them) thus they often undervalue professional services. About half of Gen Z and younger millennials are choosing to live at home, and seniors are choosing to “Age In Place”, which will further impact the HVAC needs of a home. John Ellis commented that he’s seen a lot more homeowners choosing to extend the life of their existing systems instead of opting for replacement due to a lack of financial liquidity.

And one more thought – the HVAC industry has been hearing about “pent-up demand” for a decade. Perhaps this pent-up demand is masking a new kind of recession that we’ve entered a while ago. We’re seeing the market conditions for pent-up demand, but not the expected growth. If you’re a business leader in this industry, these market anomalies should cause you to step back and consider what preparations are needed to weather an immense storm on the horizon.

If you want to survive and thrive, you need an edge. You need to rethink your company’s tools, processes, and culture and create a resilient business model that adapts to the market conditions.

In part 2, we teach you how to plug your leaky bucket by creating a Full Stack HVAC business.

This article completely captures my 45 years (and counting) of HVAC industry experience. I can honestly say that these are the most exciting times I'm experiencing so far. If you don't recognize these changes all around you, you should wake up fast. The businesses I consult with now see the need for change and invest in it. Every single town in America will support an awesome service business that's operating profitably with integrity.

Nice job laying this out, Ben Reed!

The information you have shared in this article raises important considerations for HVAC companies looking to optimize their maintenance programs. It's a reminder that while loss leaders can be effective in attracting customers, a strategic approach to upselling is crucial for long-term profitability and success in the industry.